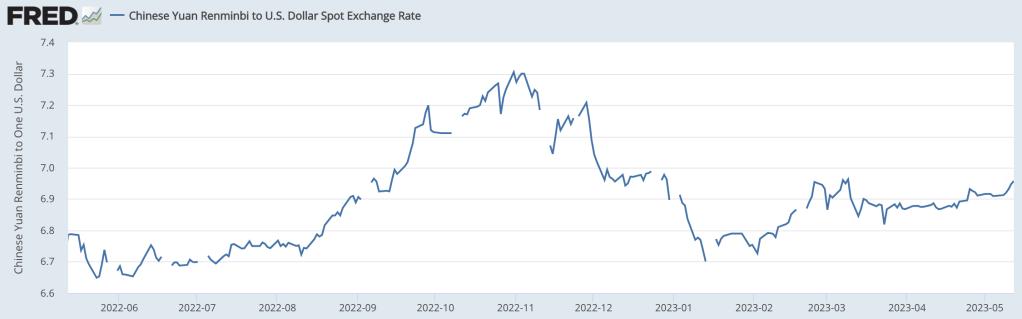

China’s central bank, the People’s Bank of China (PBOC), has said that it will “resolutely curb large fluctuations” in the exchange rate. The comment comes after the yuan dropped to multi-month lows. The PBOC said that it will work with the forex regulator to guide expectations, correct pro-cyclical and one-sided behavior, and curb speculation.

The PBOC also said that it will strengthen self-discipline management of U.S. dollar deposit businesses, improve currency hedging services for firms, and reduce the cost of hedging for small and medium-sized firms. The move comes as China’s economy faces a number of challenges, including a sputtering recovery, low yields, and the U.S. dollar’s broad rally.

The PBOC’s statement is a sign that the Chinese government is aware about recent weakness in the yuan. Keep in mind, currency depreciation 1) makes exports more competitive (lead to increased profits for exporters in the country), 2) reduce imports (international goods become more expensive) and 3) attract tourists.

Leave a comment